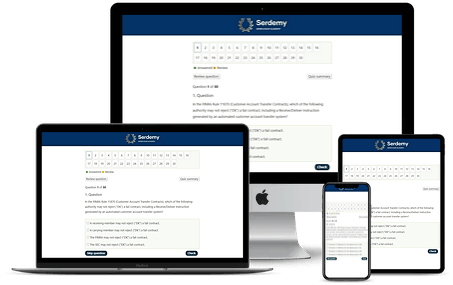

Quiz-summary

0 of 30 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

Information

Premium Practice Questions

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 30 questions answered correctly

Your time:

Time has elapsed

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- Answered

- Review

-

Question 1 of 30

1. Question

Kenji, a Branch Manager at a registered Introducing Broker, is reviewing a request from Anika, one of his Associated Persons. Anika wants to distribute a sophisticated market analysis report to prospective clients. The report was created by a reputable, independent third-party analytics firm and contains extensive hypothetical performance projections based on a proprietary algorithm. To satisfy his supervisory duties under NFA Compliance Rules, what is the most critical action Kenji must take before approving the use of this report?

Correct

NFA Compliance Rule 2-29 sets forth stringent requirements for communications with the public and promotional material. When such material includes hypothetical trading results, it is subject to particularly rigorous standards to prevent it from being misleading. The rule mandates that any presentation of hypothetical performance must be accompanied by a specific disclaimer explaining the inherent limitations of such results, for instance, that they do not represent actual trading and that past results are not indicative of future performance. Furthermore, NFA Compliance Rule 2-9 establishes the supervisory obligations of NFA Members. A Member firm, and by extension its Branch Manager, is ultimately responsible for the activities of its Associated Persons. This supervisory duty cannot be delegated to an outside party. Therefore, when an AP wishes to use promotional material created by a third party, the Branch Manager cannot simply rely on the third party’s reputation or a simple attestation of compliance. The manager must implement and follow the firm’s written supervisory procedures, which must include a process for the substantive review and prior approval of all promotional material used by its employees. This review must ensure the material, regardless of its origin, adheres to all applicable NFA rules, including the specific content and disclosure requirements for hypothetical performance data outlined in Rule 2-29. The responsibility for ensuring compliance rests squarely with the NFA Member firm and its supervisory personnel.

Incorrect

NFA Compliance Rule 2-29 sets forth stringent requirements for communications with the public and promotional material. When such material includes hypothetical trading results, it is subject to particularly rigorous standards to prevent it from being misleading. The rule mandates that any presentation of hypothetical performance must be accompanied by a specific disclaimer explaining the inherent limitations of such results, for instance, that they do not represent actual trading and that past results are not indicative of future performance. Furthermore, NFA Compliance Rule 2-9 establishes the supervisory obligations of NFA Members. A Member firm, and by extension its Branch Manager, is ultimately responsible for the activities of its Associated Persons. This supervisory duty cannot be delegated to an outside party. Therefore, when an AP wishes to use promotional material created by a third party, the Branch Manager cannot simply rely on the third party’s reputation or a simple attestation of compliance. The manager must implement and follow the firm’s written supervisory procedures, which must include a process for the substantive review and prior approval of all promotional material used by its employees. This review must ensure the material, regardless of its origin, adheres to all applicable NFA rules, including the specific content and disclosure requirements for hypothetical performance data outlined in Rule 2-29. The responsibility for ensuring compliance rests squarely with the NFA Member firm and its supervisory personnel.

-

Question 2 of 30

2. Question

Assessment of Momentum Alpha Advisors’, a registered CTA, proposed new promotional material reveals a plan to feature its flagship program, which has a five-year operational history. The material also aims to include performance data for a new, untested algorithmic strategy, which is derived from back-testing historical market data. As the Branch Manager responsible for reviewing this material under NFA Compliance Rule 2-9, what specific combination of actions and disclosures must you ensure is implemented for the material to be compliant?

Correct

This is a conceptual question without a numerical calculation. The correct course of action is determined by applying NFA Compliance Rules, primarily NFA Compliance Rule 2-29 concerning Communications with the Public and Promotional Material. First, when a CTA presents its actual performance record, the results must be presented net of all commissions, fees, and expenses. Presenting gross performance is considered misleading. Second, NFA rules require that the performance history shown must cover the preceding five years or the entire life of the program, whichever is shorter. Since the program in question has been operating for five years, the full five-year performance record must be included in the promotional material. Selectively showing a shorter, more favorable period is prohibited. Third, the use of hypothetical trading results is strictly regulated. The material must explicitly state that the results are hypothetical. Furthermore, a specific prescribed disclaimer must be included, which details the inherent limitations of hypothetical results, such as the fact that they do not represent actual trading, may not have been impacted by market factors like lack of liquidity, and were prepared with the benefit of hindsight. Finally, when both actual and hypothetical performance are presented in the same material, they must be given equal prominence. It is a violation to highlight or emphasize the hypothetical results over the actual trading record. The Branch Manager’s supervisory duty under NFA Compliance Rule 2-9 includes ensuring all promotional materials created by the firm and its Associated Persons adhere to these strict standards before dissemination to the public.

Incorrect

This is a conceptual question without a numerical calculation. The correct course of action is determined by applying NFA Compliance Rules, primarily NFA Compliance Rule 2-29 concerning Communications with the Public and Promotional Material. First, when a CTA presents its actual performance record, the results must be presented net of all commissions, fees, and expenses. Presenting gross performance is considered misleading. Second, NFA rules require that the performance history shown must cover the preceding five years or the entire life of the program, whichever is shorter. Since the program in question has been operating for five years, the full five-year performance record must be included in the promotional material. Selectively showing a shorter, more favorable period is prohibited. Third, the use of hypothetical trading results is strictly regulated. The material must explicitly state that the results are hypothetical. Furthermore, a specific prescribed disclaimer must be included, which details the inherent limitations of hypothetical results, such as the fact that they do not represent actual trading, may not have been impacted by market factors like lack of liquidity, and were prepared with the benefit of hindsight. Finally, when both actual and hypothetical performance are presented in the same material, they must be given equal prominence. It is a violation to highlight or emphasize the hypothetical results over the actual trading record. The Branch Manager’s supervisory duty under NFA Compliance Rule 2-9 includes ensuring all promotional materials created by the firm and its Associated Persons adhere to these strict standards before dissemination to the public.

-

Question 3 of 30

3. Question

A branch manager at Apex Futures Strategists, Ms. Valeriano, is reviewing a new piece of promotional material developed by one of her associated persons (APs). The material prominently features a performance chart for a new trading program, “Momentum Alpha.” A label at the bottom of the chart reads “HYPOTHETICAL PERFORMANCE – FOR ILLUSTRATIVE PURPOSES ONLY.” The chart shows impressive returns over the past 12 months, a period highly favorable to the strategy. The material does not contain any other disclaimers related to the nature of the hypothetical results. In her supervisory review, what is the most significant compliance failure Ms. Valeriano must identify and correct under NFA Compliance Rule 2-29?

Correct

This is a qualitative assessment based on NFA rules, not a quantitative calculation. The conclusion is derived from a direct application of NFA Compliance Rule 2-29 and its associated Interpretive Notice regarding the use of hypothetical performance results in promotional materials. The core issue is the complete omission of the mandatory prescriptive disclaimer for hypothetical results. NFA rules are extremely specific about what must be stated when presenting hypothetical performance. The required disclaimer must convey several key points: that the results are simulated, that they do not represent actual trading, that they have inherent limitations because they are prepared with the benefit of hindsight, and, critically, that no representation is being made that any account will or is likely to achieve profits or losses similar to those being shown. The absence of this specific, mandated language is a significant violation of NFA Compliance Rule 2-29. While other aspects of the material, such as the time period covered or the prominence of labels, are also subject to regulatory scrutiny under the general principles of fair and balanced communication, the failure to include the explicitly required disclaimer is a direct and unambiguous breach of a core requirement. The purpose of this rule is to prevent the public from being misled by the often-flattering nature of simulated results and to ensure they understand the significant differences between hypothetical performance and actual trading outcomes. A branch manager’s supervisory duty includes ensuring that all promotional materials strictly adhere to these disclosure requirements before they are disseminated to the public.

Incorrect

This is a qualitative assessment based on NFA rules, not a quantitative calculation. The conclusion is derived from a direct application of NFA Compliance Rule 2-29 and its associated Interpretive Notice regarding the use of hypothetical performance results in promotional materials. The core issue is the complete omission of the mandatory prescriptive disclaimer for hypothetical results. NFA rules are extremely specific about what must be stated when presenting hypothetical performance. The required disclaimer must convey several key points: that the results are simulated, that they do not represent actual trading, that they have inherent limitations because they are prepared with the benefit of hindsight, and, critically, that no representation is being made that any account will or is likely to achieve profits or losses similar to those being shown. The absence of this specific, mandated language is a significant violation of NFA Compliance Rule 2-29. While other aspects of the material, such as the time period covered or the prominence of labels, are also subject to regulatory scrutiny under the general principles of fair and balanced communication, the failure to include the explicitly required disclaimer is a direct and unambiguous breach of a core requirement. The purpose of this rule is to prevent the public from being misled by the often-flattering nature of simulated results and to ensure they understand the significant differences between hypothetical performance and actual trading outcomes. A branch manager’s supervisory duty includes ensuring that all promotional materials strictly adhere to these disclosure requirements before they are disseminated to the public.

-

Question 4 of 30

4. Question

Kenji is the Branch Manager for a registered Commodity Trading Advisor (CTA). He is conducting a supervisory review of a new marketing slideshow prepared by a third-party consulting firm. The slideshow prominently displays the performance of a select group of accounts labeled the “Momentum Strategy,” which shows significantly higher returns than the CTA’s overall composite performance as reported in its current Disclosure Document. The slideshow includes all standard NFA-required disclaimers, including that past performance is not indicative of future results. From a supervisory standpoint under NFA Compliance Rule 2-29, what is Kenji’s most critical responsibility regarding this material?

Correct

The core issue revolves around NFA Compliance Rule 2-29, which governs communications with the public and promotional material. A fundamental principle of this rule is that all communications must be fair, balanced, and not misleading. While disclaimers are necessary, they cannot cure a presentation that is fundamentally misleading in its structure or content. NFA rules are particularly stringent regarding the presentation of performance results. Presenting the performance of a subset of accounts, especially one that is more favorable than the overall composite performance of the trading program, is generally prohibited. This practice is considered presumptively misleading because it involves “cherry-picking” the best-performing accounts, which does not provide a fair and balanced view of the manager’s skill or the typical client’s experience. The performance presented in promotional material must be consistent with the performance presented in the firm’s Disclosure Document. The Branch Manager, under their supervisory obligations outlined in NFA Compliance Rule 2-9, is directly responsible for reviewing and approving all promotional materials to ensure they comply with NFA rules. In this situation, the manager’s primary duty is to identify that the use of a selective, high-performing subset of accounts is a violation and to prevent the material from being used.

Incorrect

The core issue revolves around NFA Compliance Rule 2-29, which governs communications with the public and promotional material. A fundamental principle of this rule is that all communications must be fair, balanced, and not misleading. While disclaimers are necessary, they cannot cure a presentation that is fundamentally misleading in its structure or content. NFA rules are particularly stringent regarding the presentation of performance results. Presenting the performance of a subset of accounts, especially one that is more favorable than the overall composite performance of the trading program, is generally prohibited. This practice is considered presumptively misleading because it involves “cherry-picking” the best-performing accounts, which does not provide a fair and balanced view of the manager’s skill or the typical client’s experience. The performance presented in promotional material must be consistent with the performance presented in the firm’s Disclosure Document. The Branch Manager, under their supervisory obligations outlined in NFA Compliance Rule 2-9, is directly responsible for reviewing and approving all promotional materials to ensure they comply with NFA rules. In this situation, the manager’s primary duty is to identify that the use of a selective, high-performing subset of accounts is a violation and to prevent the material from being used.

-

Question 5 of 30

5. Question

Assessment of an Associated Person’s trading patterns is a key function of a branch manager. Kenji, a branch manager, is conducting his monthly review of discretionary accounts managed by his AP, Maria. He observes that following a major agricultural report, Maria entered identical short soybean futures positions in all seven of the discretionary accounts she manages. While all clients had granted full discretion and the positions are currently profitable, the clients have varying documented risk tolerances and investment objectives, ranging from conservative income to aggressive speculation. According to NFA rules on supervision, what should be Kenji’s primary concern and most appropriate initial action?

Correct

The core responsibility of a branch manager under NFA Compliance Rule 2-9 is to diligently supervise employees and their activities, including the handling of discretionary accounts. When reviewing trading in such accounts, the manager must look beyond simple profitability or adherence to basic order entry rules. A key supervisory concern is ensuring that every trade executed is suitable for the specific client in whose account it was placed. The fact that an Associated Person is placing identical or highly similar trades across multiple, distinct discretionary accounts should trigger a supervisory inquiry. This pattern raises a significant red flag that the AP may be treating the separate accounts as a single, homogenous block, effectively running a de facto commodity pool without the required registrations or disclosures. This approach fails to consider the unique financial situations, investment objectives, risk tolerance, and needs of each individual client. Profitability of the trades is irrelevant to this fundamental suitability obligation. The manager’s primary duty is not to assume efficiency but to verify that the AP’s trading rationale for each account was based on that specific account’s individual circumstances. The appropriate supervisory action is to investigate the rationale behind the trading pattern by discussing it with the AP and cross-referencing the trades against the documented client profiles and objectives for each account involved. This proactive review is essential to demonstrate that a robust supervisory system for discretionary accounts is in place and being followed.

Incorrect

The core responsibility of a branch manager under NFA Compliance Rule 2-9 is to diligently supervise employees and their activities, including the handling of discretionary accounts. When reviewing trading in such accounts, the manager must look beyond simple profitability or adherence to basic order entry rules. A key supervisory concern is ensuring that every trade executed is suitable for the specific client in whose account it was placed. The fact that an Associated Person is placing identical or highly similar trades across multiple, distinct discretionary accounts should trigger a supervisory inquiry. This pattern raises a significant red flag that the AP may be treating the separate accounts as a single, homogenous block, effectively running a de facto commodity pool without the required registrations or disclosures. This approach fails to consider the unique financial situations, investment objectives, risk tolerance, and needs of each individual client. Profitability of the trades is irrelevant to this fundamental suitability obligation. The manager’s primary duty is not to assume efficiency but to verify that the AP’s trading rationale for each account was based on that specific account’s individual circumstances. The appropriate supervisory action is to investigate the rationale behind the trading pattern by discussing it with the AP and cross-referencing the trades against the documented client profiles and objectives for each account involved. This proactive review is essential to demonstrate that a robust supervisory system for discretionary accounts is in place and being followed.

-

Question 6 of 30

6. Question

Consider a scenario where Momentum Macro Fund, a registered CPO, has been utilizing its current NFA-filed Disclosure Document for ten months. The document accurately states that its sole principal, Alistair Vance, has no material conflicts of interest. This week, Alistair’s spouse was appointed to the board of directors of Agri-Synth Corp., a major agricultural technology firm. The fund currently holds substantial long positions in agricultural futures contracts. As the branch manager overseeing the CPO’s operations, what is the most immediate and critical compliance obligation for Momentum Macro Fund under NFA rules?

Correct

The core regulatory principle at issue is the requirement for a Commodity Pool Operator’s Disclosure Document to be materially accurate and complete at all times it is in use, as mandated by NFA Compliance Rule 2-13 and CFTC Regulation 4.26. When a material event occurs that renders the existing Disclosure Document misleading or incomplete, the CPO has an immediate obligation. The appointment of a principal’s spouse to the board of a company directly related to the pool’s investment strategy constitutes a significant, material conflict of interest that was not previously disclosed. The existing document, which presumably stated no such conflicts, is now materially inaccurate. Therefore, the CPO must immediately stop using the outdated document to solicit or accept funds from new participants. The next step is to promptly prepare an amendment to the Disclosure Document that fully and clearly describes the new conflict of interest. This amended document must be filed with the NFA. Only after the amendment is filed can the CPO resume using the newly updated Disclosure Document for prospective clients. Simply waiting for the next scheduled annual update is not permissible for a material change, as it would mean using a misleading document for a prolonged period.

Incorrect

The core regulatory principle at issue is the requirement for a Commodity Pool Operator’s Disclosure Document to be materially accurate and complete at all times it is in use, as mandated by NFA Compliance Rule 2-13 and CFTC Regulation 4.26. When a material event occurs that renders the existing Disclosure Document misleading or incomplete, the CPO has an immediate obligation. The appointment of a principal’s spouse to the board of a company directly related to the pool’s investment strategy constitutes a significant, material conflict of interest that was not previously disclosed. The existing document, which presumably stated no such conflicts, is now materially inaccurate. Therefore, the CPO must immediately stop using the outdated document to solicit or accept funds from new participants. The next step is to promptly prepare an amendment to the Disclosure Document that fully and clearly describes the new conflict of interest. This amended document must be filed with the NFA. Only after the amendment is filed can the CPO resume using the newly updated Disclosure Document for prospective clients. Simply waiting for the next scheduled annual update is not permissible for a material change, as it would mean using a misleading document for a prolonged period.

-

Question 7 of 30

7. Question

Anika is the Branch Manager for Apex Futures, an NFA Member firm. One of her top-producing Associated Persons, Kenji, wants to distribute a sophisticated performance analysis report to prospective high-net-worth clients. The report was generated by a reputable third-party analytics vendor and contains extensive hypothetical performance data based on a proprietary trading model. Kenji argues that since the vendor is a well-known industry leader, the report should be acceptable for use. To ensure compliance with NFA rules, what is Anika’s most critical supervisory obligation?

Correct

The core of this issue rests on the intersection of NFA Compliance Rule 2-9, which mandates diligent supervision, and NFA Compliance Rule 2-29, which governs communications with the public and promotional material. Even though the performance report was created by a third-party vendor, the NFA Member firm and its supervisory personnel, such as the Branch Manager, retain full and non-delegable responsibility for ensuring its compliance with all applicable rules. The Branch Manager cannot simply rely on the vendor’s reputation or assurances. Under Rule 2-29, any material designed to solicit public accounts, including a third-party report, is considered promotional material. Material containing hypothetical trading results is subject to particularly strict requirements. The Branch Manager must ensure the report includes prominent disclosures explaining the limitations of hypothetical results and the material assumptions made in their preparation. Furthermore, Rule 2-9 requires the firm to have and enforce written supervisory procedures. A critical component of these procedures is the prior review and written approval of all promotional material by an appropriate supervisor before it is used. Therefore, the Branch Manager’s primary duty is to personally conduct a thorough review of the report against the standards of Rule 2-29, document this review, and provide explicit written approval before the Associated Person is permitted to distribute it. This internal, documented approval process is the cornerstone of demonstrating adequate supervision and cannot be outsourced or bypassed. The firm must also maintain a copy of the material and the approval record for the required retention period.

Incorrect

The core of this issue rests on the intersection of NFA Compliance Rule 2-9, which mandates diligent supervision, and NFA Compliance Rule 2-29, which governs communications with the public and promotional material. Even though the performance report was created by a third-party vendor, the NFA Member firm and its supervisory personnel, such as the Branch Manager, retain full and non-delegable responsibility for ensuring its compliance with all applicable rules. The Branch Manager cannot simply rely on the vendor’s reputation or assurances. Under Rule 2-29, any material designed to solicit public accounts, including a third-party report, is considered promotional material. Material containing hypothetical trading results is subject to particularly strict requirements. The Branch Manager must ensure the report includes prominent disclosures explaining the limitations of hypothetical results and the material assumptions made in their preparation. Furthermore, Rule 2-9 requires the firm to have and enforce written supervisory procedures. A critical component of these procedures is the prior review and written approval of all promotional material by an appropriate supervisor before it is used. Therefore, the Branch Manager’s primary duty is to personally conduct a thorough review of the report against the standards of Rule 2-29, document this review, and provide explicit written approval before the Associated Person is permitted to distribute it. This internal, documented approval process is the cornerstone of demonstrating adequate supervision and cannot be outsourced or bypassed. The firm must also maintain a copy of the material and the approval record for the required retention period.

-

Question 8 of 30

8. Question

An assessment of a proposed operational change at an Introducing Broker’s branch office involves a new third-party software system. This system is designed to analyze market data to generate trading signals and then automatically draft promotional emails for clients based on these signals. Kenji, the Branch Manager, is tasked with evaluating the implementation of this system. Considering Kenji’s duties under NFA Compliance Rules, which of the following represents his most critical and immediate supervisory responsibility before allowing the use of this third-party system?

Correct

The core responsibility of the Branch Manager is to establish, maintain, and enforce adequate written supervisory procedures for the review and approval of all communications generated by the third-party system before they are disseminated to any current or prospective clients. NFA Compliance Rule 2-9 places the ultimate responsibility for diligent supervision of all futures-related activities on the NFA Member firm and its designated supervisors, such as the Branch Manager. This fundamental duty cannot be delegated or outsourced to a third-party vendor, regardless of the vendor’s own compliance attestations or technological sophistication. When a firm incorporates a third-party system for generating communications with the public, it is adopting that output as its own. Consequently, these communications fall squarely under the purview of NFA Compliance Rule 2-29, which governs promotional material. Rule 2-29 requires that all promotional material be reviewed and approved by an appropriate supervisory employee before its first use. Therefore, the most critical and immediate obligation for the Branch Manager is to create a robust internal control framework. This framework must include specific written procedures detailing how every piece of system-generated content will be captured, reviewed for fairness, balance, and accuracy, and formally approved by a qualified principal before it can be sent. Simply relying on the vendor’s claims of compliance or focusing on customer disclosures without first establishing this internal supervisory review process would represent a significant failure to meet the core requirements of NFA Rule 2-9.

Incorrect

The core responsibility of the Branch Manager is to establish, maintain, and enforce adequate written supervisory procedures for the review and approval of all communications generated by the third-party system before they are disseminated to any current or prospective clients. NFA Compliance Rule 2-9 places the ultimate responsibility for diligent supervision of all futures-related activities on the NFA Member firm and its designated supervisors, such as the Branch Manager. This fundamental duty cannot be delegated or outsourced to a third-party vendor, regardless of the vendor’s own compliance attestations or technological sophistication. When a firm incorporates a third-party system for generating communications with the public, it is adopting that output as its own. Consequently, these communications fall squarely under the purview of NFA Compliance Rule 2-29, which governs promotional material. Rule 2-29 requires that all promotional material be reviewed and approved by an appropriate supervisory employee before its first use. Therefore, the most critical and immediate obligation for the Branch Manager is to create a robust internal control framework. This framework must include specific written procedures detailing how every piece of system-generated content will be captured, reviewed for fairness, balance, and accuracy, and formally approved by a qualified principal before it can be sent. Simply relying on the vendor’s claims of compliance or focusing on customer disclosures without first establishing this internal supervisory review process would represent a significant failure to meet the core requirements of NFA Rule 2-9.

-

Question 9 of 30

9. Question

An evaluative review of Momentum Alpha Strategies, a registered Commodity Trading Advisor (CTA), reveals a potential disclosure issue. Anika, the firm’s Branch Manager, discovers that one of the CTA’s principals, Leo, was a control person at a securities firm eight years ago that was censured and fined by FINRA for inadequate supervisory procedures. Leo was not personally named or fined in the action. Momentum Alpha’s current disclosure document, which is seven months old and actively being used to solicit clients, makes no mention of this event. What is the most appropriate course of action for Anika to ensure compliance with NFA rules?

Correct

The core of this issue revolves around the concept of materiality and the continuous obligation to maintain an accurate and not misleading Commodity Trading Advisor (CTA) disclosure document under NFA and CFTC rules. The analysis proceeds as follows. First, we must identify if the discovered information is material. NFA rules require the disclosure of a principal’s business background for the preceding five years, including any material administrative, civil, or criminal actions. While the FINRA action occurred eight years ago, outside the standard five-year window for mandatory action disclosures, the concept of materiality for the general business background section is broader. An action against a firm for supervisory failures where an individual was a principal (a control person) is highly relevant to their qualifications and management history. A potential client would likely consider this information important in their decision-making process, thus making it material. Second, upon discovery of a material fact that was omitted, the CTA has an immediate obligation. NFA Compliance Rule 2-13 and CFTC regulations mandate that a disclosure document must be amended promptly when it becomes materially inaccurate or incomplete. Continuing to use a document with a material omission would be a violation. Third, the required action is to amend the document. This involves adding a clear and complete description of the FINRA action and the principal’s role at the firm at that time. This amended document must then be filed with the NFA. Fourth, the deficient document cannot be used to solicit or accept new clients. Therefore, the CTA must cease using the current disclosure document until the amended version has been prepared and filed with the NFA. The Branch Manager’s supervisory duty is to ensure these corrective steps are taken immediately to comply with the regulations.

Incorrect

The core of this issue revolves around the concept of materiality and the continuous obligation to maintain an accurate and not misleading Commodity Trading Advisor (CTA) disclosure document under NFA and CFTC rules. The analysis proceeds as follows. First, we must identify if the discovered information is material. NFA rules require the disclosure of a principal’s business background for the preceding five years, including any material administrative, civil, or criminal actions. While the FINRA action occurred eight years ago, outside the standard five-year window for mandatory action disclosures, the concept of materiality for the general business background section is broader. An action against a firm for supervisory failures where an individual was a principal (a control person) is highly relevant to their qualifications and management history. A potential client would likely consider this information important in their decision-making process, thus making it material. Second, upon discovery of a material fact that was omitted, the CTA has an immediate obligation. NFA Compliance Rule 2-13 and CFTC regulations mandate that a disclosure document must be amended promptly when it becomes materially inaccurate or incomplete. Continuing to use a document with a material omission would be a violation. Third, the required action is to amend the document. This involves adding a clear and complete description of the FINRA action and the principal’s role at the firm at that time. This amended document must then be filed with the NFA. Fourth, the deficient document cannot be used to solicit or accept new clients. Therefore, the CTA must cease using the current disclosure document until the amended version has been prepared and filed with the NFA. The Branch Manager’s supervisory duty is to ensure these corrective steps are taken immediately to comply with the regulations.

-

Question 10 of 30

10. Question

Kenji is the Branch Manager for “Momentum Futures Advisors,” a registered Commodity Trading Advisor (CTA). He is conducting a supervisory review of a new draft brochure intended for prospective clients. The brochure’s centerpiece is a large, prominent chart illustrating a 45% return for the CTA’s flagship “Alpha Trend Program.” However, this return only reflects the single best-performing quarter since the program’s inception three years ago. The full three-year track record is not shown. A small-print disclaimer at the bottom of the page states that past performance is not necessarily indicative of future results. To ensure compliance with NFA rules, what is Kenji’s most critical supervisory obligation regarding this material?

Correct

NFA Compliance Rule 2-29 governs communications with the public and promotional material. A core principle of this rule is that all such communications must be based on principles of fair dealing and good faith and must not be misleading. When a CTA presents its performance history, it must do so in a manner that is fair and balanced. Highlighting an isolated period of exceptional performance while omitting the broader context of the program’s full history is considered misleading, as it can create an unrealistic expectation for prospective clients. The inclusion of a standard risk disclaimer, such as “past performance is not indicative of future results,” does not cure a presentation that is fundamentally unbalanced or deceptive. The supervisor’s responsibility is to ensure that the material provides a comprehensive and representative picture of the trading program’s performance. This means the performance data should cover the entire life of the program or a sufficiently long period to avoid cherry-picking favorable results. Furthermore, any presented performance must be net of all commissions, fees, and expenses that a client would have incurred, ensuring the figures reflect a realistic client experience. Simply footnoting that a specific period was the best one is also insufficient, as the prominent, initial impression remains skewed. The ultimate goal is to provide the public with the necessary information to make a well-informed decision, which requires a complete and unvarnished presentation of performance over time.

Incorrect

NFA Compliance Rule 2-29 governs communications with the public and promotional material. A core principle of this rule is that all such communications must be based on principles of fair dealing and good faith and must not be misleading. When a CTA presents its performance history, it must do so in a manner that is fair and balanced. Highlighting an isolated period of exceptional performance while omitting the broader context of the program’s full history is considered misleading, as it can create an unrealistic expectation for prospective clients. The inclusion of a standard risk disclaimer, such as “past performance is not indicative of future results,” does not cure a presentation that is fundamentally unbalanced or deceptive. The supervisor’s responsibility is to ensure that the material provides a comprehensive and representative picture of the trading program’s performance. This means the performance data should cover the entire life of the program or a sufficiently long period to avoid cherry-picking favorable results. Furthermore, any presented performance must be net of all commissions, fees, and expenses that a client would have incurred, ensuring the figures reflect a realistic client experience. Simply footnoting that a specific period was the best one is also insufficient, as the prominent, initial impression remains skewed. The ultimate goal is to provide the public with the necessary information to make a well-informed decision, which requires a complete and unvarnished presentation of performance over time.

-

Question 11 of 30

11. Question

Consider a scenario where Lin, a branch office manager for an Introducing Broker, terminates an Associated Person, Marco, for consistently failing to meet performance metrics. Lin promptly files a Form 8-T, indicating the reason for termination was not for cause related to sales practices or other rule violations. Ten days after Marco’s termination, during a supervisory review of his past client communications, Lin uncovers definitive evidence that Marco was regularly using a non-firm, unapproved personal messaging application to provide specific trading advice to a client. What is the primary regulatory action Lin’s firm must now take in accordance with NFA rules?

Correct

Under NFA Compliance Rule 2-9, a Member firm has a continuing responsibility to diligently supervise its employees and their activities. This supervisory duty does not cease at the moment of an Associated Person’s termination; it extends to a review of the activities that occurred during the AP’s tenure. When a Member firm terminates an AP, it must file a Form 8-T, the Notice of Termination, in accordance with NFA Bylaw 1101. This form includes questions regarding the reason for termination, including whether it was for cause related to sales practices, fraud, or other rule violations. If, after filing the initial Form 8-T, the firm discovers new information that would have required an affirmative answer to these disciplinary-related questions, the firm is obligated to act. Specifically, the firm must file an amended Form 8-T within 30 days of discovering this new information. In the described situation, the discovery that the AP used unapproved communication channels for making trade recommendations constitutes a serious violation of communication and supervision rules. This is precisely the type of information that would necessitate an amendment to the termination filing to accurately reflect the circumstances surrounding the AP’s departure for regulatory and public record purposes. Failing to amend the filing would be a violation of the firm’s reporting and supervisory obligations.

Incorrect

Under NFA Compliance Rule 2-9, a Member firm has a continuing responsibility to diligently supervise its employees and their activities. This supervisory duty does not cease at the moment of an Associated Person’s termination; it extends to a review of the activities that occurred during the AP’s tenure. When a Member firm terminates an AP, it must file a Form 8-T, the Notice of Termination, in accordance with NFA Bylaw 1101. This form includes questions regarding the reason for termination, including whether it was for cause related to sales practices, fraud, or other rule violations. If, after filing the initial Form 8-T, the firm discovers new information that would have required an affirmative answer to these disciplinary-related questions, the firm is obligated to act. Specifically, the firm must file an amended Form 8-T within 30 days of discovering this new information. In the described situation, the discovery that the AP used unapproved communication channels for making trade recommendations constitutes a serious violation of communication and supervision rules. This is precisely the type of information that would necessitate an amendment to the termination filing to accurately reflect the circumstances surrounding the AP’s departure for regulatory and public record purposes. Failing to amend the filing would be a violation of the firm’s reporting and supervisory obligations.

-

Question 12 of 30

12. Question

Assessment of a branch office’s new marketing initiative reveals a potential compliance gap. The office, managed by Leilani, has engaged a third-party marketing consultant to create and host webinars aimed at attracting new clients for the firm’s managed futures programs. The consultant assures Leilani that they are experts in financial marketing and all content will be compliant. Which of the following actions, or inactions, represents the most critical supervisory failure by Leilani under NFA Compliance Rules 2-9 and 2-29?

Correct

NFA Compliance Rule 2-29 governs communications with the public and promotional material. A core principle of this rule is that NFA Members are fully responsible for the content of all promotional materials used on their behalf, regardless of who created them. This responsibility extends to materials prepared by third-party consultants or advertising firms. A Member firm cannot delegate its compliance responsibilities. Consequently, any material created by a third party must be treated as if the Member firm created it internally. This directly implicates the supervisory duties outlined in NFA Compliance Rule 2-9. This rule requires each Member to diligently supervise its employees and agents in all aspects of their futures activities. For a Branch Manager, this includes establishing, maintaining, and enforcing written supervisory procedures. These procedures must cover the review and approval of all promotional material before it is used. The pre-approval must be conducted by an appropriate supervisory employee who holds a relevant principal registration. Failing to review and formally approve third-party promotional material prior to its dissemination constitutes a significant breakdown of the supervisory system required by Rule 2-9. It is not sufficient to rely on a third party’s assurances of compliance or to review the material after it has already been presented to the public. The supervisory obligation is proactive, requiring prior review and approval to prevent potential violations before they occur. This proactive supervision is the cornerstone of ensuring that all communications with the public are fair, balanced, and not misleading.

Incorrect

NFA Compliance Rule 2-29 governs communications with the public and promotional material. A core principle of this rule is that NFA Members are fully responsible for the content of all promotional materials used on their behalf, regardless of who created them. This responsibility extends to materials prepared by third-party consultants or advertising firms. A Member firm cannot delegate its compliance responsibilities. Consequently, any material created by a third party must be treated as if the Member firm created it internally. This directly implicates the supervisory duties outlined in NFA Compliance Rule 2-9. This rule requires each Member to diligently supervise its employees and agents in all aspects of their futures activities. For a Branch Manager, this includes establishing, maintaining, and enforcing written supervisory procedures. These procedures must cover the review and approval of all promotional material before it is used. The pre-approval must be conducted by an appropriate supervisory employee who holds a relevant principal registration. Failing to review and formally approve third-party promotional material prior to its dissemination constitutes a significant breakdown of the supervisory system required by Rule 2-9. It is not sufficient to rely on a third party’s assurances of compliance or to review the material after it has already been presented to the public. The supervisory obligation is proactive, requiring prior review and approval to prevent potential violations before they occur. This proactive supervision is the cornerstone of ensuring that all communications with the public are fair, balanced, and not misleading.

-

Question 13 of 30

13. Question

Leto, a Branch Office Manager for an Introducing Broker, is evaluating a request from an Associated Person (AP) in his office. The AP wants to distribute a market analysis report to prospective clients that was created by “Quant-Analytics,” an independent third-party research firm that is not an NFA Member. The report contains sophisticated analysis and includes projected performance based on a hypothetical trading model. Assessment of this proposal requires Leto to determine his primary supervisory obligation under NFA rules. Which of the following actions correctly defines Leto’s primary responsibility before approving the use of this report?

Correct

Under NFA Compliance Rule 2-29, a Member firm is ultimately responsible for the content of all promotional material it uses to solicit customers, even if that material was prepared by a third party. The Member cannot delegate this responsibility. When a firm decides to use third-party material, it is considered to have adopted the material as its own. Therefore, the Branch Office Manager, as part of their supervisory duties under NFA Compliance Rule 2-9, must conduct a thorough review to ensure the material complies with all applicable NFA rules as if the firm had created it internally. This includes verifying that all claims can be substantiated and that the presentation is fair and not misleading. Specifically, when promotional material contains hypothetical trading results, there are stringent requirements. The material must include a specific cautionary statement prescribed by the NFA, explaining the limitations of hypothetical results. The firm must also be prepared to provide a detailed explanation of how the hypothetical results were calculated and all the assumptions that were made. Simply obtaining a disclaimer from the third-party creator or attributing the work to them is insufficient to meet the firm’s regulatory obligations. The firm must perform its own due diligence on the content and stand behind its accuracy and fairness. The supervisory process must be documented, demonstrating that the material was reviewed and approved by an appropriate supervisory person prior to its first use.

Incorrect

Under NFA Compliance Rule 2-29, a Member firm is ultimately responsible for the content of all promotional material it uses to solicit customers, even if that material was prepared by a third party. The Member cannot delegate this responsibility. When a firm decides to use third-party material, it is considered to have adopted the material as its own. Therefore, the Branch Office Manager, as part of their supervisory duties under NFA Compliance Rule 2-9, must conduct a thorough review to ensure the material complies with all applicable NFA rules as if the firm had created it internally. This includes verifying that all claims can be substantiated and that the presentation is fair and not misleading. Specifically, when promotional material contains hypothetical trading results, there are stringent requirements. The material must include a specific cautionary statement prescribed by the NFA, explaining the limitations of hypothetical results. The firm must also be prepared to provide a detailed explanation of how the hypothetical results were calculated and all the assumptions that were made. Simply obtaining a disclaimer from the third-party creator or attributing the work to them is insufficient to meet the firm’s regulatory obligations. The firm must perform its own due diligence on the content and stand behind its accuracy and fairness. The supervisory process must be documented, demonstrating that the material was reviewed and approved by an appropriate supervisory person prior to its first use.

-

Question 14 of 30

14. Question

Anika, the Branch Manager at Momentum Strategies, LLC, a registered CTA, is conducting her final review of a new promotional brochure for their proprietary “Velocity” trading program. The brochure prominently features a chart showing a five-year back-tested hypothetical performance record with impressive returns. While reviewing the material, Anika recalls that for the past six months, the firm has been managing three actual client accounts using the exact same “Velocity” program. The actual performance of these accounts, while positive, is substantially less impressive than the long-term hypothetical results. The brochure makes no mention of these actual accounts or their performance. Based on NFA Compliance Rules, what is the primary compliance failure Anika must address regarding this promotional material?

Correct

The core issue in this scenario relates to NFA Compliance Rule 2-29, which governs communications with the public and promotional material. Specifically, section (c) of this rule places strict conditions on the use of hypothetical performance results. A key provision states that if a Commodity Trading Advisor (CTA) has managed actual accounts using the same trading program being promoted, the performance of those actual accounts must be presented with equal or greater prominence than the hypothetical results. The rule is designed to prevent firms from selectively presenting only favorable back-tested data while omitting potentially less impressive real-world results. In this case, Momentum Strategies, LLC has been managing actual accounts with its “Velocity” program for six months. By creating promotional material that exclusively features the five-year back-tested hypothetical results and completely omits the performance of the actual accounts it is also managing, the firm is engaging in a practice that is misleading and a direct violation of NFA rules. The significant difference between the hypothetical and actual results makes this omission even more material. The Branch Manager’s supervisory duty under NFA Compliance Rule 2-9 requires her to identify this failure and ensure the promotional material is corrected to include the actual performance data before it is distributed to the public.

Incorrect

The core issue in this scenario relates to NFA Compliance Rule 2-29, which governs communications with the public and promotional material. Specifically, section (c) of this rule places strict conditions on the use of hypothetical performance results. A key provision states that if a Commodity Trading Advisor (CTA) has managed actual accounts using the same trading program being promoted, the performance of those actual accounts must be presented with equal or greater prominence than the hypothetical results. The rule is designed to prevent firms from selectively presenting only favorable back-tested data while omitting potentially less impressive real-world results. In this case, Momentum Strategies, LLC has been managing actual accounts with its “Velocity” program for six months. By creating promotional material that exclusively features the five-year back-tested hypothetical results and completely omits the performance of the actual accounts it is also managing, the firm is engaging in a practice that is misleading and a direct violation of NFA rules. The significant difference between the hypothetical and actual results makes this omission even more material. The Branch Manager’s supervisory duty under NFA Compliance Rule 2-9 requires her to identify this failure and ensure the promotional material is corrected to include the actual performance data before it is distributed to the public.

-

Question 15 of 30

15. Question

Ananya is the Branch Manager for an Introducing Broker. A severe weather event has triggered the firm’s Business Continuity and Disaster Recovery Plan (BCDRP), requiring all personnel, including Ananya and her Associated Person (AP), Leo, to work remotely. Leo, concerned about client retention, drafts an email for his client list that discusses a proprietary trading model. The email states, “Our back-tested ‘Vol-Catcher’ strategy would have produced substantial gains during the recent market turmoil.” He forwards the draft to Ananya for a quick review, stating his intent to send it out within the hour. Given the circumstances and NFA rules, which of the following describes the most appropriate and immediate supervisory action Ananya must take?

Correct

The core issue involves the intersection of a Branch Manager’s supervisory duties under NFA Compliance Rule 2-9, the specific regulations for promotional material under NFA Compliance Rule 2-29, and the operational challenges presented by a Business Continuity and Disaster Recovery Plan activation. The email drafted by the Associated Person, Leo, clearly constitutes promotional material because it is designed to solicit or maintain client accounts by highlighting the performance of a trading system. Under NFA Rule 2-29, the use of hypothetical performance results is strictly regulated and requires specific, extensive disclaimers to be presented. These disclaimers must warn clients that hypothetical results have inherent limitations, are not indicative of actual future results, and do not represent actual trading, among other points. Leo’s draft, which lacks these disclosures, would be a serious violation. The Branch Manager’s primary responsibility under Rule 2-9 is to diligently supervise the activities of the firm’s employees and agents. This duty is not suspended or lessened during a BCDRP event. Therefore, the most critical and immediate supervisory action is to prevent the dissemination of non-compliant material. The manager must review the material before use and ensure it complies with all NFA rules. This means she must explicitly prohibit the AP from sending the communication until it is brought into full compliance, which includes adding all mandatory disclaimers for hypothetical performance. Documenting this directive is also a key part of the supervisory process. Allowing the communication to be sent, even with a plan for later review, would constitute a failure to supervise.

Incorrect

The core issue involves the intersection of a Branch Manager’s supervisory duties under NFA Compliance Rule 2-9, the specific regulations for promotional material under NFA Compliance Rule 2-29, and the operational challenges presented by a Business Continuity and Disaster Recovery Plan activation. The email drafted by the Associated Person, Leo, clearly constitutes promotional material because it is designed to solicit or maintain client accounts by highlighting the performance of a trading system. Under NFA Rule 2-29, the use of hypothetical performance results is strictly regulated and requires specific, extensive disclaimers to be presented. These disclaimers must warn clients that hypothetical results have inherent limitations, are not indicative of actual future results, and do not represent actual trading, among other points. Leo’s draft, which lacks these disclosures, would be a serious violation. The Branch Manager’s primary responsibility under Rule 2-9 is to diligently supervise the activities of the firm’s employees and agents. This duty is not suspended or lessened during a BCDRP event. Therefore, the most critical and immediate supervisory action is to prevent the dissemination of non-compliant material. The manager must review the material before use and ensure it complies with all NFA rules. This means she must explicitly prohibit the AP from sending the communication until it is brought into full compliance, which includes adding all mandatory disclaimers for hypothetical performance. Documenting this directive is also a key part of the supervisory process. Allowing the communication to be sent, even with a plan for later review, would constitute a failure to supervise.

-

Question 16 of 30

16. Question

Anika, a Branch Manager at a Guaranteed Introducing Broker, is conducting her supervisory review of a new marketing initiative proposed by one of her Associated Persons, Kenji. Kenji wants to use a seminar presentation and brochure created by a third-party vendor, “Market Signal Analytics.” Upon review, Anika notes the brochure prominently features back-tested hypothetical performance results from the vendor’s trading model and includes an unattributed testimonial praising the system. Furthermore, a central slide in the seminar presentation asserts that the system’s signals are “engineered to produce consistent, guaranteed returns.” From a supervisory standpoint under NFA rules, which of the following represents the most critical failure if Anika were to approve this material for use without any changes?

Correct

The core responsibility of a Branch Manager under NFA Compliance Rule 2-9 is to diligently supervise the activities of the firm’s employees and Associated Persons. This supervisory duty extends to all communications with the public, which are governed by NFA Compliance Rule 2-29. When an Associated Person proposes using promotional material, especially from a third-party, the manager must review it to ensure it complies with all NFA rules before its first use. The firm, by using the material, adopts it as its own and is fully responsible for its content. Rule 2-29 strictly prohibits any statement that is misleading or makes any guarantee. The claim of “guaranteed returns” is a fundamental violation because futures trading involves substantial risk of loss and is not suitable for all investors; no outcome can ever be guaranteed. Approving material with such a claim represents a severe failure in the supervisory duty to ensure that communications are fair, balanced, and not deceptive. While other issues, such as the presentation of hypothetical performance data and the use of testimonials, are also strictly regulated, they are secondary to the primary prohibition against guaranteeing profits. Hypothetical performance data requires specific disclaimers about its inherent limitations, and testimonials must be properly attributed and disclose any compensation. However, allowing a direct promise of guaranteed returns fundamentally misrepresents the nature of the product and constitutes the most serious breach of both the specific rules on promotional material and the general supervisory obligations.

Incorrect

The core responsibility of a Branch Manager under NFA Compliance Rule 2-9 is to diligently supervise the activities of the firm’s employees and Associated Persons. This supervisory duty extends to all communications with the public, which are governed by NFA Compliance Rule 2-29. When an Associated Person proposes using promotional material, especially from a third-party, the manager must review it to ensure it complies with all NFA rules before its first use. The firm, by using the material, adopts it as its own and is fully responsible for its content. Rule 2-29 strictly prohibits any statement that is misleading or makes any guarantee. The claim of “guaranteed returns” is a fundamental violation because futures trading involves substantial risk of loss and is not suitable for all investors; no outcome can ever be guaranteed. Approving material with such a claim represents a severe failure in the supervisory duty to ensure that communications are fair, balanced, and not deceptive. While other issues, such as the presentation of hypothetical performance data and the use of testimonials, are also strictly regulated, they are secondary to the primary prohibition against guaranteeing profits. Hypothetical performance data requires specific disclaimers about its inherent limitations, and testimonials must be properly attributed and disclose any compensation. However, allowing a direct promise of guaranteed returns fundamentally misrepresents the nature of the product and constitutes the most serious breach of both the specific rules on promotional material and the general supervisory obligations.

-

Question 17 of 30

17. Question

A Commodity Trading Advisor (CTA) has developed a new algorithmic trading strategy. Before deploying the strategy with any client funds, the firm creates promotional material showcasing the strategy’s performance over the past five years using back-tested historical data. Leto, the Branch Office Manager, is responsible for reviewing and approving this material before its use, in accordance with NFA Compliance Rule 2-9. To ensure compliance with NFA Rule 2-29 regarding hypothetical performance, which of the following is the most critical action Leto must verify?

Correct

NFA Compliance Rule 2-29 and its related Interpretive Notices govern communications with the public and promotional material. A critical area of this rule concerns the presentation of hypothetical trading results. When a Commodity Trading Advisor (CTA) or other NFA Member presents performance that was not achieved in an actual account, it is considered hypothetical. The NFA has very strict requirements for this because of the potential for such results to be misleading. Hypothetical results can be skewed by the benefit of hindsight and do not reflect the impact of actual market conditions, liquidity constraints, or the psychological pressures of managing real money. To comply with NFA rules, any promotional material containing hypothetical results must include a specific, prescribed disclaimer. This disclaimer must state that hypothetical performance results have many inherent limitations, some of which are described. It must explicitly state that no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. It must also explain that hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. The presence of this complete, prescribed warning is a non-negotiable requirement for any material using hypothetical performance.

Incorrect

NFA Compliance Rule 2-29 and its related Interpretive Notices govern communications with the public and promotional material. A critical area of this rule concerns the presentation of hypothetical trading results. When a Commodity Trading Advisor (CTA) or other NFA Member presents performance that was not achieved in an actual account, it is considered hypothetical. The NFA has very strict requirements for this because of the potential for such results to be misleading. Hypothetical results can be skewed by the benefit of hindsight and do not reflect the impact of actual market conditions, liquidity constraints, or the psychological pressures of managing real money. To comply with NFA rules, any promotional material containing hypothetical results must include a specific, prescribed disclaimer. This disclaimer must state that hypothetical performance results have many inherent limitations, some of which are described. It must explicitly state that no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. It must also explain that hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. The presence of this complete, prescribed warning is a non-negotiable requirement for any material using hypothetical performance.

-

Question 18 of 30

18. Question

An evaluative review of a proposed advertising campaign for a Commodity Trading Advisor (CTA) is being conducted by the Branch Manager of its guarantor FCM. The campaign, created by a third-party consultant, prominently features a chart showing a 12-month period of exceptional gains. A footnote clarifies that the data is from the CTA’s NFA-filed Disclosure Document and that past performance does not guarantee future results. The full five-year performance history in the Disclosure Document, which includes periods of significant drawdowns, is not shown in the advertisement. From a supervisory perspective under NFA rules, what is the most significant compliance failure that the Branch Manager must address?

Correct

Not Applicable Under NFA Compliance Rule 2-29, all communications with the public by an NFA Member, including promotional material, must be based on principles of fair dealing and good faith and must not be misleading. A core tenet of this rule is that any presentation of performance history must be balanced and provide a complete picture. While the data presented might be factually accurate and derived from the official Disclosure Document, the act of “cherry-picking” a specific, highly successful period and presenting it in isolation is inherently misleading. It creates an exaggerated impression of the trading program’s typical performance and potential for future success. The inclusion of a standard disclaimer, such as “past performance is not indicative of future results,” is a necessary but not sufficient condition for compliance. Such a disclaimer does not cure a presentation that is fundamentally unbalanced or misleading in its emphasis. The supervising Branch Manager, under NFA Compliance Rule 2-9, has a direct responsibility to review and approve such materials, ensuring they provide proper context. This includes giving equal or greater prominence to required disclosures and ensuring that a selective presentation of profitable periods does not obscure the full, long-term performance record, which includes periods of losses and drawdowns. The use of a third-party marketing firm does not transfer this compliance responsibility away from the NFA Member.

Incorrect

Not Applicable Under NFA Compliance Rule 2-29, all communications with the public by an NFA Member, including promotional material, must be based on principles of fair dealing and good faith and must not be misleading. A core tenet of this rule is that any presentation of performance history must be balanced and provide a complete picture. While the data presented might be factually accurate and derived from the official Disclosure Document, the act of “cherry-picking” a specific, highly successful period and presenting it in isolation is inherently misleading. It creates an exaggerated impression of the trading program’s typical performance and potential for future success. The inclusion of a standard disclaimer, such as “past performance is not indicative of future results,” is a necessary but not sufficient condition for compliance. Such a disclaimer does not cure a presentation that is fundamentally unbalanced or misleading in its emphasis. The supervising Branch Manager, under NFA Compliance Rule 2-9, has a direct responsibility to review and approve such materials, ensuring they provide proper context. This includes giving equal or greater prominence to required disclosures and ensuring that a selective presentation of profitable periods does not obscure the full, long-term performance record, which includes periods of losses and drawdowns. The use of a third-party marketing firm does not transfer this compliance responsibility away from the NFA Member.

-

Question 19 of 30

19. Question

Kenji, the branch manager at Apex Futures, an IB, is reviewing a proposal from an Associated Person (AP) to distribute a reprint of an article from a respected financial journal. The article favorably discusses a managed futures program offered by the firm. To ensure compliance with NFA Compliance Rule 2-29, what is the most critical set of actions Kenji must mandate before approving the use of this reprint?

Correct

Under NFA Compliance Rule 2-29, any third-party material, such as an article reprint, that an NFA member uses for promotional purposes is treated as if the member firm itself created the material. This places the full responsibility for the content’s accuracy, fairness, and balance directly on the firm and its supervisors, like the branch manager. The rule strictly prohibits altering or highlighting the reprint in any way that could misrepresent the original content or give undue prominence to certain sections. A critical compliance requirement is that the reprint must clearly display its original publication date. Furthermore, if the article does not already do so, the member firm must add a clear disclosure of any material connections or compensation arrangements that exist between the author or the publication and the NFA member or its principals. Most importantly, the reprint must be accompanied by all necessary risk disclosures that are required for any piece of promotional material, ensuring that potential customers receive a balanced view that includes the inherent risks of futures trading. The branch manager has a direct supervisory responsibility to ensure all these conditions are met before the material is distributed to the public, and to maintain records demonstrating a reasonable basis for believing the information is not misleading.

Incorrect

Under NFA Compliance Rule 2-29, any third-party material, such as an article reprint, that an NFA member uses for promotional purposes is treated as if the member firm itself created the material. This places the full responsibility for the content’s accuracy, fairness, and balance directly on the firm and its supervisors, like the branch manager. The rule strictly prohibits altering or highlighting the reprint in any way that could misrepresent the original content or give undue prominence to certain sections. A critical compliance requirement is that the reprint must clearly display its original publication date. Furthermore, if the article does not already do so, the member firm must add a clear disclosure of any material connections or compensation arrangements that exist between the author or the publication and the NFA member or its principals. Most importantly, the reprint must be accompanied by all necessary risk disclosures that are required for any piece of promotional material, ensuring that potential customers receive a balanced view that includes the inherent risks of futures trading. The branch manager has a direct supervisory responsibility to ensure all these conditions are met before the material is distributed to the public, and to maintain records demonstrating a reasonable basis for believing the information is not misleading.

-

Question 20 of 30

20. Question

Anika, a branch office manager for a guaranteed introducing broker, is conducting her annual on-site audit. She discovers that one of her most productive Associated Persons, Mateo, has been communicating with a high-net-worth prospective client using a personal, encrypted messaging application that is not approved or monitored by the firm. The conversation history, which Mateo reluctantly shows her, includes detailed discussions of a new CTA’s proprietary trading algorithm and its potential for high returns. From a supervisory standpoint under NFA rules, what is the most significant compliance failure that Anika must address?

Correct

No calculation is required for this question. NFA Compliance Rule 2-9 imposes a direct and affirmative duty on every NFA Member to diligently supervise its employees and agents in all aspects of their futures activities. This supervisory responsibility is broad and encompasses all business-related communications. Furthermore, NFA Compliance Rule 2-29, which governs communications with the public, defines promotional material very broadly to include any communication made to the public in connection with soliciting a futures account, property, or service. This includes electronic communications. A Member firm must establish, maintain, and enforce written supervisory procedures that are reasonably designed to prevent and detect violations of NFA and CFTC rules. A critical component of these procedures is the monitoring and retention of business-related correspondence. The use of unapproved, third-party, or encrypted messaging applications for business communications presents a significant supervisory challenge. The fundamental failure in such a scenario is the absence of a system capable of capturing, reviewing, and retaining these communications. While the content of the messages might constitute unapproved promotional material, and the use of the specific application might be prohibited, the core violation from a branch manager’s perspective is the breakdown of the supervisory system itself. The inability to monitor the communication channel is the root cause that allows other potential violations to occur undetected. The supervisory framework must be robust enough to either prevent the use of such channels for business or to ensure that any communications conducted through them are captured and reviewed.

Incorrect

No calculation is required for this question. NFA Compliance Rule 2-9 imposes a direct and affirmative duty on every NFA Member to diligently supervise its employees and agents in all aspects of their futures activities. This supervisory responsibility is broad and encompasses all business-related communications. Furthermore, NFA Compliance Rule 2-29, which governs communications with the public, defines promotional material very broadly to include any communication made to the public in connection with soliciting a futures account, property, or service. This includes electronic communications. A Member firm must establish, maintain, and enforce written supervisory procedures that are reasonably designed to prevent and detect violations of NFA and CFTC rules. A critical component of these procedures is the monitoring and retention of business-related correspondence. The use of unapproved, third-party, or encrypted messaging applications for business communications presents a significant supervisory challenge. The fundamental failure in such a scenario is the absence of a system capable of capturing, reviewing, and retaining these communications. While the content of the messages might constitute unapproved promotional material, and the use of the specific application might be prohibited, the core violation from a branch manager’s perspective is the breakdown of the supervisory system itself. The inability to monitor the communication channel is the root cause that allows other potential violations to occur undetected. The supervisory framework must be robust enough to either prevent the use of such channels for business or to ensure that any communications conducted through them are captured and reviewed.

-

Question 21 of 30

21. Question